Background

The London housing market has been in the doldrums for several years. Rob Perrins, Executive Chair of Berkeley Group, described last year as “…even worse than after the 2008 financial crash…”

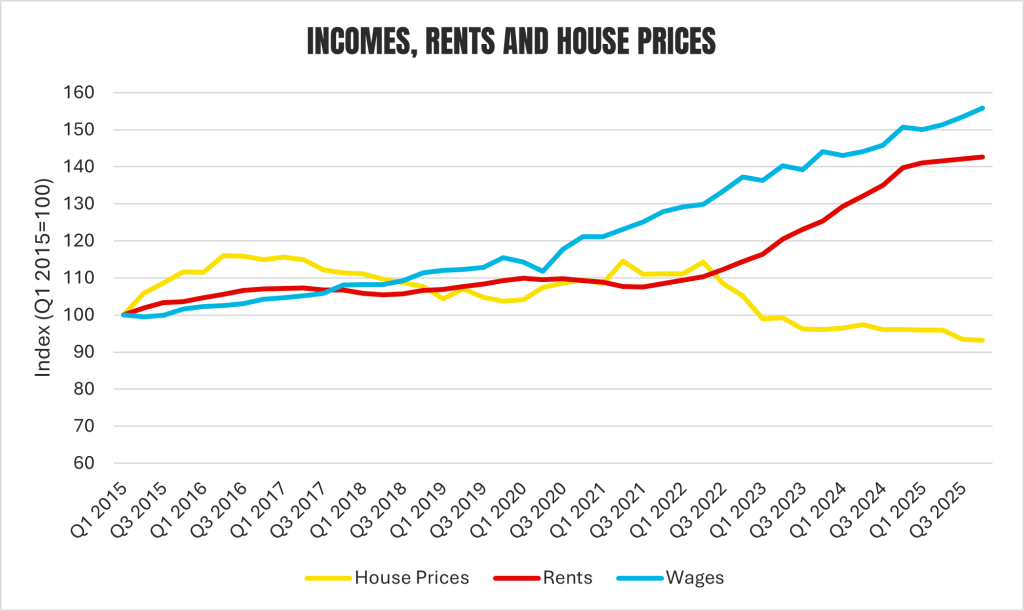

On paper, house prices in the capital have fallen by 2% since their mid-2022 peak – although that translates to an 18% fall if adjusted for inflation. Meanwhile, rents rose by 3.7% per annum between October 2022 and 2025, but that translates to a slight real-terms fall.

Similarly, transaction volumes have never recovered the 120,000–160,000 ballpark they saw before the Global Financial Crisis. And while 80,000–100,000 became the new normal in the 2010s, they have since fallen to 60,000–80,000.

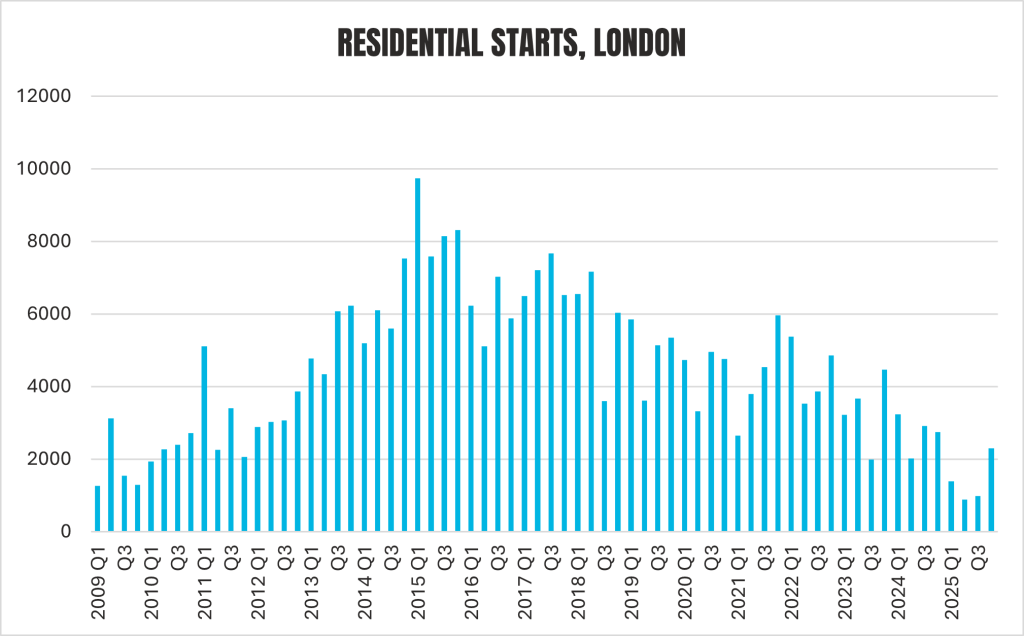

And most starkly of all, development has collapsed. There were just 2,940 starts in 2025, by far the lowest on record; even during 2009, the worst year of the financial crisis , London saw 14,140 starts. To put this in perspective, the year with the next lowest starts was 2024, with 6,600. So, the last two years have been a disaster for housing development in our nation’s capital.

Completions, for obvious reasons, have taken longer to fall back, but 2025’s 11,590 still represents the lowest on record, although by a much slimmer margin.

Source: Molior

Early signs of improving viability emerge

However, there are signs that from this very low base, the situation is starting to improve. The figures quoted above from Central Government show an extremely modest increase in starts in London, from 4,020 in Q2 to 4,220 in Q3. But the much timelier data produced by specialist provider Molior shows starts increasing from just 870 in Q2 and 986 in Q3 to 2,294 in Q4 – the highest in a year.

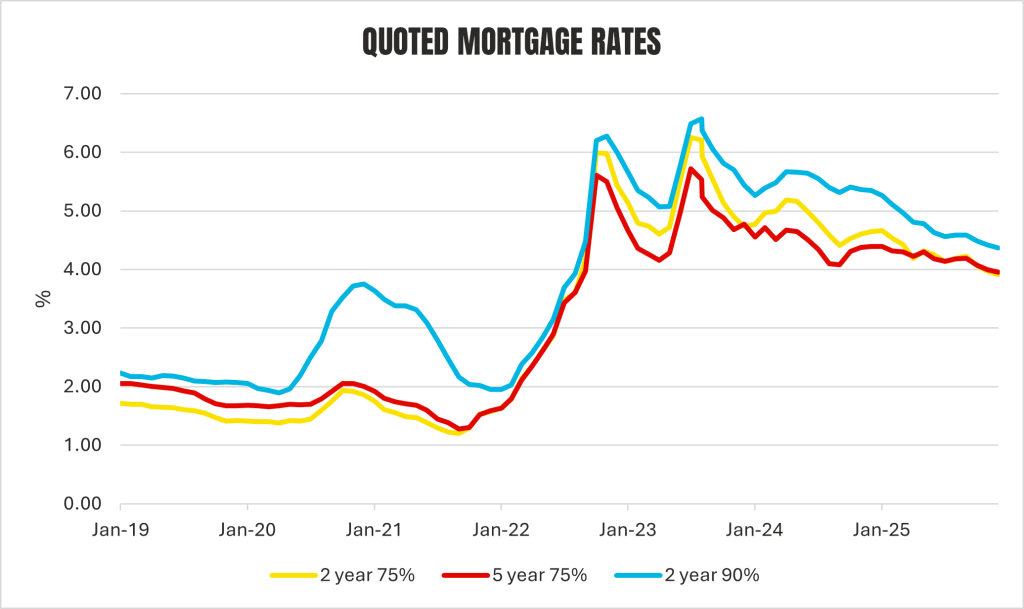

Adrian Owen, Partner & Head of Residential at Montagu Evans, believes: “I have seen a number of cycles in my 30-year career but nothing as bad as this dire crisis in London but as a firm with a strong pedigree in the housing sector, we believe that we are at the bottom. There are further signs that the ‘perfect storm’ that made vast swathes of projects unviable is beginning to subside. While construction costs remain elevated, debt costs are falling, albeit slowly. But more importantly, as part of its wider focus on increasing housing delivery, the government is beginning to pay attention to the dire situation in London, so much worse than in the wider country, amid wider fears of a loss of industry capacity that could take years to repair.”