It is important to note that looking at retail as a single sector masks the significant range in value movements within the subsectors, not least of which is driven by in-town/out-of-town market dynamics.

Across the retail sector there has been a long-held position that liabilities are too high and disproportionately penalise bricks and mortar operators. Following significant lobbying by retailers directly and through trade bodies, notably the British Retail Consortium there will finally be some genuine relief applicable to many. Other than the highest value properties and portfolios, businesses should generally anticipate falling values and liabilities from April 2026.

Although the overall rental movement between April 2021 and April 2024 was flat/marginally falling, this sector showed significant variation across subsectors, with the main highlights being

- Retail warehousing demonstrated the greatest resilience with marginal rental growth. The highest figure for that subsector was 6% in Scotland, with its different valuation date

- Standard high street units have seen falling values in all but the strongest locations

- Out-of-town centres have shown significantly more growth than town centre locations

This altered retail landscape largely reflects the greater resilience of out-of-town retail – from bulky goods to discount operators – in the face of competition from online. Town centres have struggled partly because of the dearth of office workers, so it remains to be seen whether this segment will bounce back as office attendance increases.

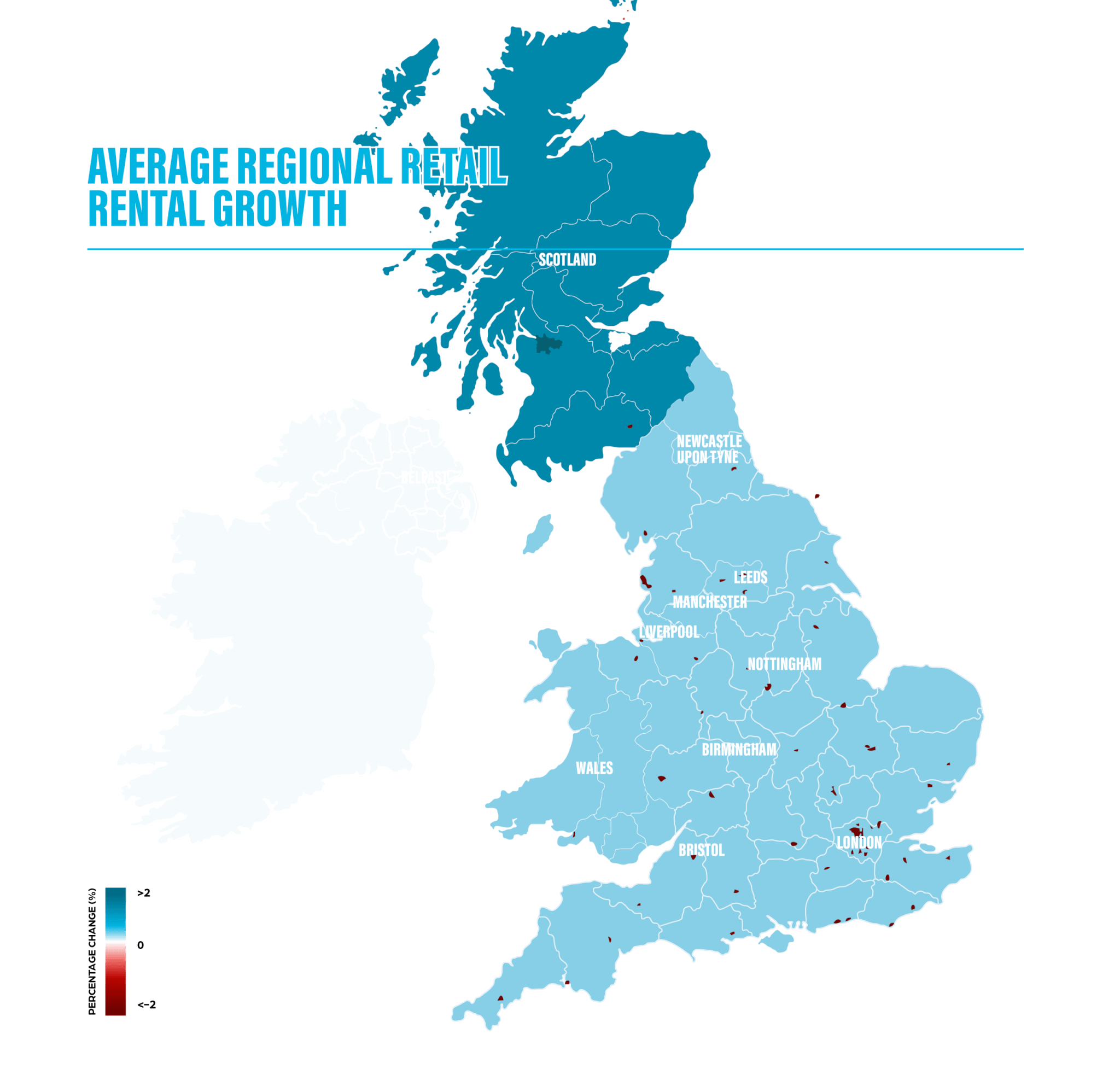

Rental growth remains negative in the retail sector overall at -0.6%, although this varies hugely by type, with retail warehousing in modestly positive territory. The highest figure for that subsector was 6% in Scotland, with 3% recorded in the East Midlands and South West. Some regions (North West, North East) nevertheless saw moderate falls in rent (-1%).

Standard high street retail suffered rather more, with regional figures varying from -5% in the East Midlands and South West to -1% in the North West and West Midlands. This may reflect the greater importance of large cities such as Manchester, Liverpool and Birmingham in those two regions, which have performed somewhat better as retail destinations than many smaller cities and towns.

The only positive outturn for standard retail was suburban London (ie. not Central) at 0.4%, with the West End seeing a -1.4% fall. While shopping centre data is not given at a regional level, there was a marked divergence between in-town centres (-5.4%) and out-of-town centres (1.1% increase). Rental growth in retail is not as polarised as in other sectors, with the top 25% seeing 2.0% growth, the median flat, and the bottom 25% -2.2%.

In short, this implies that the rates burden will fall somewhat for retail, where most out-of-town locations may see some very modest increases, compared to most in-town markets experiencing the reverse, except perhaps the best micro-locations within the core cities.