Predictions that many companies would move to a remote-only model following the experience of the pandemic have not come to pass, at least not in the mainstream. A hybrid model has become most commonplace, with companies increasingly requiring 2-3 days a week minimum attendance, although recently there has been a trend to insist on a more frequent presence.

This has intensified a recent phenomenon – that companies are increasingly focused on best-in-class space. Older, poorly specified offices can struggle to find tenants or investors. Concerns over environmental sustainability and whether a hybrid model might lead to a reduction in aggregate occupation levels are further reasons for the increasingly evident market polarisation.

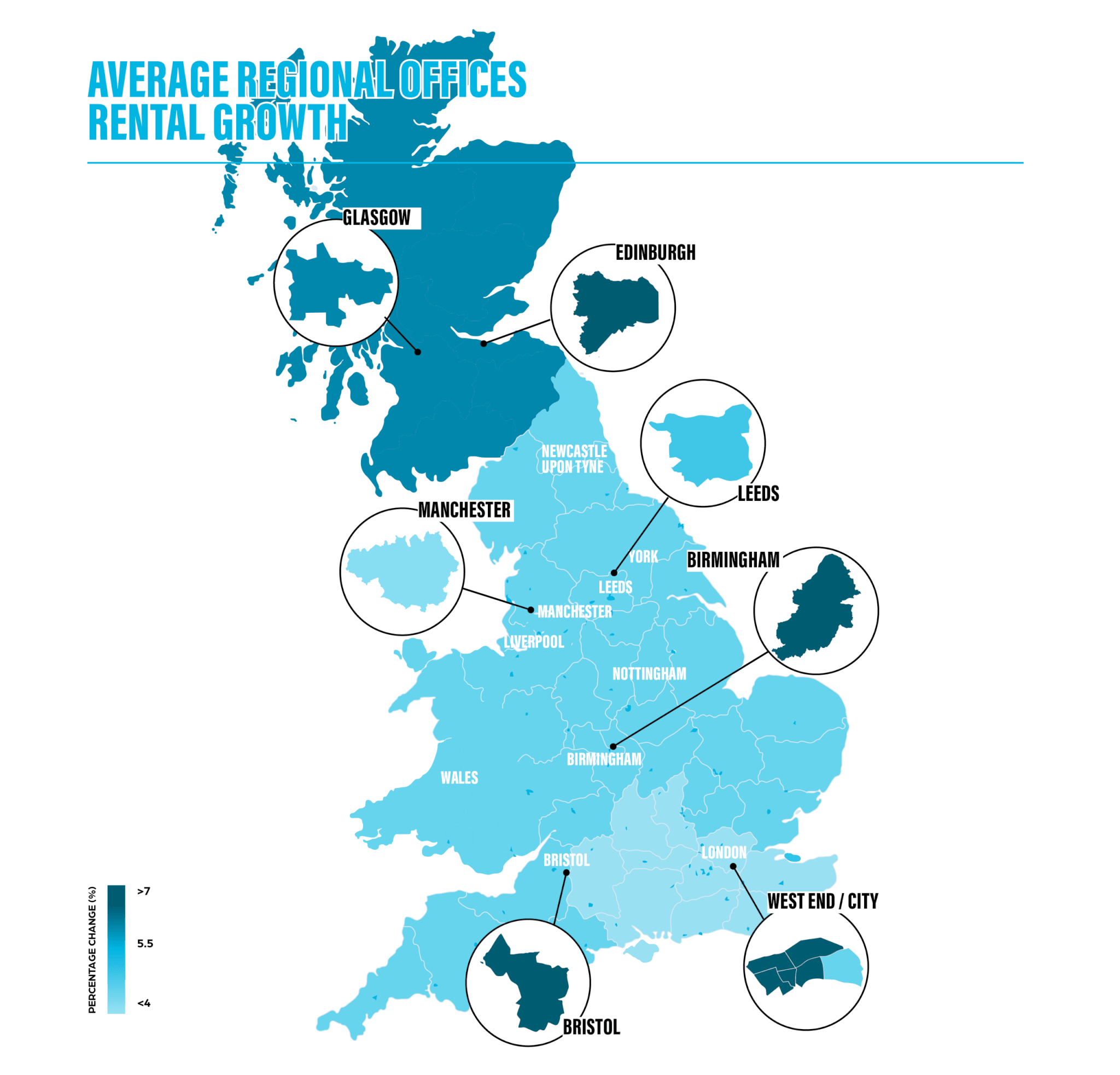

Currently accounting for around 23% of all rateable values, this sector has seen modest rental growth of 6.0% – below inflation – since the last Revaluation. There is, however, no consistent picture within the sector. There is significant variation by location and quality, producing a range of value movements from modest reductions to growth approaching 15% where demand is strongest.

At these levels, many ratepayers can anticipate liabilities remaining broadly the same or even slightly reducing from current levels. However, differentials in poundage are likely to materially impact liabilities for larger office occupiers.

Locations in the Oxford-Cambridge corridor such as Cambridge itself (14%) and Milton Keynes (13%) saw the steepest increases, followed by the supply-constrained West End (10%).

In contrast, the City of London saw just 4% growth with a closer balance between demand and the ongoing development of new office space.

Of the main cities outside the capital, Birmingham (8%) and Bristol (7%) had the strongest growth, whereas Manchester was the lowest of the Big Six at 4%, perhaps reflecting high levels of recent construction rather than underlying weak demand. Edinburgh and Glasgow, on the different valuation date of 31 March 2025, saw higher increases of 13% and 7% respectively, as the existing values from 31 March 2022 had already seen a significant correction.

More surprisingly, office parks, particularly outside the South East, outperformed at 6%. This may reflect their value for money compared to urban locations, combined potentially with an increase in out-of-town demand given changes in working patterns post-pandemic.

With offices, however, it is important to note that the rental growth figures are largely driven by the top 25% of the sample, which recorded over 9% rental growth over the period – while other parts of the market were almost completely flat. Industrial & logistics shows a strong divide, with the top 25% seeing around 37% rental growth, the median around 21%, and the bottom 25% just 7% – but in proportional terms, this is nothing like as polarised as in offices.