5 February, 2026

Montagu Evans boosts Central London focus with double Partner appointment

Learn more

26 November, 2025 · 4 min read

Businesses were waiting with anticipation for today’s budget, where the Chancellor – in summarising this budget as making strong public choices and maintaining a stable economy – set out several changes to steer the UK economy over the coming 12 months.

As anticipated, business rates were high on the agenda. We knew the Chancellor would be seeking to strike a balance between encouraging economic growth, whilst at the same time protecting local Government income.

This budget included measures that will impact what businesses will be paying come April next year, including an extension of established rates retention schemes in several locations until 2029. There will also be a 10-year extension of the relief afforded to electric vehicle charging points to encompass EV-only forecourts.

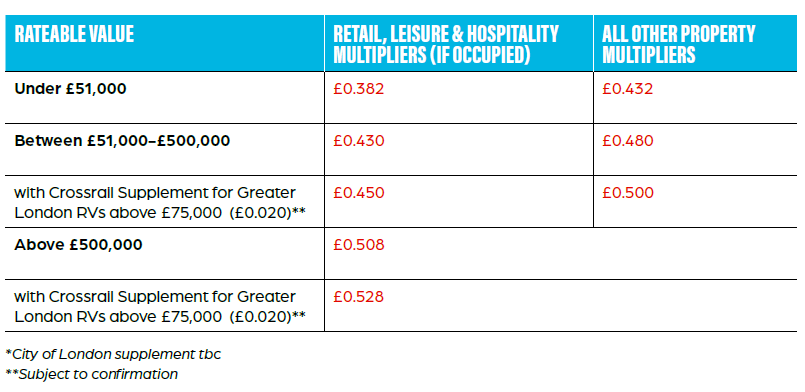

Arguably, the most significant of the changes to business rates will be the introduction of a suite of multipliers in England intended to ease the burden of the tax on approximately 750,000 Retail, Leisure and Hospitality (RHL) occupiers. Their introduction from April next year will coincide with the closure of the scheme of relief that has persisted since the COVID-19 outbreak. Ostensibly, this aligns with Government policy to support the high street and promote investment, but there will inevitably be many ratepayers who will feel aggrieved and unfairly treated.

Consequently, there will be a new and permanently lower multiplier for qualifying small properties put to prescribed ‘RHL’ uses (Rateable Value below £51k) and a separate, lower ‘standard’ RHL occupiers with a Rateable Value below £500k.

There will also be a 1p supplement for one year to pay for transitional relief. This will be charged to those that fall outside transition or small business relief scheme.

However, regardless of the use to which the premises are put, assessments with a Rateable Value above £500k will be subject for the first time to a higher rate multiplier. Occupiers of warehouses used by online retailers were cited as one of the targets, but this higher rate will, of course, have a far wider reach, including large shops, arenas and hospitals, for example.

The introduction of this higher multiplier is a key indication from the government who believe ‘big business’ can absorb the greatest increases in liability resulting from the national business rates revaluation.

The increased complexity of the system of multipliers will coincide with the 2026 revaluation in England and Wales, and the Draft Rating List was also published this afternoon by the Valuation Office Agency.

Assessments will be based on an assumption of rental value at 1 April 2024, by which date it is generally accepted that the suppression of trade on the leisure and hospitality industries had eased significantly compared to economic circumstances persisting at the current valuation date of 1 April 2021.

Early signs are that our initial prediction that leisure and hospitality properties would see some of the greatest increases in Rateable Value as a result of the 2026 revaluation would seem to be correct.

Here’s an initial breakdown of percentage Rateable Value movement by sample sector:

One strand of comfort for those hit with the largest percentage uplifts in Rateable Value will be the revised scheme of transitional relief. This smooths the effect of a revaluation by introducing artificial caps on liability increases, phased out during the life of the Rating List.

The liability caps for larger properties (above RV £100k) are slightly more generous in years 2 and 3 than under the prevailing Rating List. Also, for the first time, all multipliers will benefit from transitional relief. Meaning that those who have been subject to the greatest increases, particularly those with an assessment above Rateable Value £500k, will receive more relief than they would have been entitled to under previous schemes. However, this is likely to be of limited comfort to those affected and other ‘local supplements’, i.e., Crossrail in Greater London and the City of London security levy, will continue to be outside the scope of transitional relief.

Separately from business rates but still on the subject of property tax, there will be an additional charge through Council Tax from 2028 on homes worth more than £2m, with a £2.5k annual charge rising to £7.5k for properties worth more than £5m based upon 2026 capital values.

In light of this budget, we would encourage businesses to review their draft assessment and anticipated liabilities from April. Montagu Evans are best placed to assist and provide early advice as to how best to mitigate exposure to business rates over the forthcoming 2026 Rating List. We discuss this in our 2026 Handbook.

1 December, 2025

by Jon Neale

Learn more

19 November, 2025

by Josh Myerson

Learn more

22 October, 2025

by Mark Paterson, Julie Chalmers

Learn more